News Analysis

Capital Relief Trades

SRT Journal: Growing pains?

The first of five essays compiled in SCI's inaugural SRT Journal investigates the momentum seen this year in US CRT and its impact on supply and demand

The US Fed’s FAQ on CLNs in September 2023 sparked anticipation that the floodgates would finally open for US bank CRT issuance, resulting in many new investors exploring the sector and an initial wave of transactions. The momentum subsequently seen this year in US CRT has altered supply and demand dynamics, with some describing it as a banks’ market, due to the deluge of new capital coming into the sector. Others, meanwhile, view these developments as a natural progression of the market.

Private credit funds last year raised an estimated US$200bn-US$300bn and are motivated to deploy that capital before the investment period ends, including in strategies with an CRT element. However, the supply side of the equation haasn’t changed much.

The initial wave of issuance following the Fed’s FAQ reflected a clearing of pent-up supply from the previous period of regulatory uncertainty, according to a recent Seer Capital Management research report. The deals primarily consisted of thick tranches referencing investment grade corporate loans and thin tranches referencing auto loans, which were placed with large investors at spreads in the mid-single digits. Notably, JPMorgan sought to complete a vast amount of issuance rapidly, therefore only engaged with large investors with ticket sizes of several hundred million.

“Although a few US banks have priced very large deals, there has yet to be a meaningful increase in the number of transactions being brought to the market. More investors competing for the same amount of trades has therefore driven spreads tighter,” explains one source.

Spread tightening

SCI’s SRTx Spread Indexes show that between December 2023 and July 2024, contributors’ pricing opinions fell from 1,278bp, 1,173bp, 1,173bp and 969bp to 1,033bp, 1,000bp, 919bp and 625bp across the US SME, European SME, European corporate and US corporate SRT segments respectively.

At the same time, now that a number of US banks have become repeat issuers and are comfortable with the regulatory guardrails, execution of certain types of US CRT transactions is becoming more of a pricing matter, rather than a structuring matter – which Eri Budo Uerkwitz, counsel at Mayer Brown, describes as a “natural progression of the market”. But one issue with moving towards pricing-based execution is that not everyone that is bidding may fully understand the product.

“Given there have been so few losses and credit events in the US CRT market, it is questionable whether all investors that seek an allocation nowadays know how to underwrite a portfolio. It wouldn’t be the first time that some investors in an overflow buyers’ market do not do, or are not capable of doing, the necessary diligence and end up driving pricing down,” Uerkwitz observes.

She adds: “And pricing may also be driven down by more sophisticated investors that have raised dedicated CRT funds and now sit on funds they need to deploy. So, it’s unclear whether some funds are investing in CRT because they need to execute or because it’s their investment thesis.”

The concern is that if deal terms are being driven by less sophisticated investors seeking allocations, the pricing may not be commensurate with the true risk being transferred. “Whether the risk is inappropriately priced is debatable. If a deal is executed, ultimately it means that the protection buyer and the protection seller must agree on the price,” the source suggests.

Matthew Moniot, co-head of credit risk sharing at Man Group, doesn't believe that new investors are pushing prices to unsustainable levels. However, he says it's evident that much of the margin for error has disappeared.

“Assuming CRT pricing has not impacted the quality of loan underwriting, the reduction in spreads will likely lead to a reduction in market returns. Some participants may utilise leverage to get back to higher returns, but that will only increase their sensitivity to credit risk,” Moniot observes.

Seer, for one, did not find the initial wave of US deals attractive relative to European SRT issuance. “Given mid-single digits pricing and high minimum ticket sizes for deals backed by large corporate loans and capital call facilities, and dramatic spread tightening of the thin junior tranches of auto loan CLNs, Seer has found US reg cap deals less compelling than reg cap from other jurisdictions thus far,” the firm notes in the research report.

The Seer research cites US auto CLNs as an example, in which issuers typically retain a small first loss (bottom 1%-3%) and issue many thin mezzanine tranches (0.5%-2.25% thickness) up to a 12.5% attachment. At the same time, the dramatic spread tightening in US auto CLNs has seen second loss spreads dropping more than 1100bp and third loss spreads dropping more than 400bp.

“With such thin tranches, if losses exceed expectations, investors in the second and even third loss tranches risk losing a significant portion of their investment,” Seer warns.

The firm notes that on the back of the hype around the US market, there has been greater demand for some European transactions in recent months, but spreads overall have remained in line with the past several years. “European issuers who have established issuance programmes over the past 10-plus years continue to transact with a limited number of longstanding partners, rather than with new players who express eagerness to join the market but are unlikely to be long-term participants. We believe that in time, many US banks of all sizes will take advantage of reg cap. As the market develops and supply increases, spreads in US reg cap should widen back to appropriate levels.”

Market bifurcation

In the meantime, banks appear to be capitalising on the current demand dynamic. Sagi Tamir, partner at Mayer Brown, suggests that in this environment, two markets for US CRT transactions could emerge – a ‘straightforward’ one and a bilateral, bespoke one. The former will involve the more syndicated transactions, while the latter will evolve as it solves for unique situations, such as new asset classes, riskier portfolios of proven asset classes and unique confidentiality or proprietary challenges.

Indeed, Moniot suggests that a bifurcation is already emerging. “There is a clear distinction between the more straightforward trades, which attract non-specialist investors, and the bespoke trades that involve a genuine partnership between investor and issuer. As such, investors who leverage structuring knowledge and creativity will differentiate themselves from those who simply buy fully baked deals.”

Uerkwitz agrees that in the current environment, investors are more likely to thrive if they can overcome these differences by being creative, thoughtful and open to figuring out solutions together with an issuer. “A ‘helpful’ investor will look through to the substance of the economics of a transaction and recognise that the economics can be the same, even if the terms of the structure are different to what they are used to,” she explains.

She indicates that investors can still compete on deals that are bespoke in structure and/or reference non-standard asset classes. “Investors can maintain their market share by looking for assets that are difficult for banks to syndicate. In these scenarios, investor-issuer partnerships have real value.”

Although the US Fed’s guidance regarding Regulation Q in September 2023 provided clarity in connection with direct CLN issuances, it also placed a limit of the lower of 100% of capital and US$20bn on the principal amount of assets with respect to which a banking organisation may transfer risk via direct CLNs (SCI 29 September 2023). Since the G-SIBs are likely to blow through the US$20bn limit very quickly, it begs the question of which books banks are willing to subject to the direct CLN route.

Perhaps more saliently, indirect CLN structures that do not consolidate to the banks are consequently becoming appealing to banks that need to manage this US$20bn cap, according to Tamir. He adds that a growing number of investors are taking on responsibility for the SPV - an arrangement that is viewed as a win-win for those investors and related banks. For investors who can do this, it provides a way to win a significant allocation (up to 100%); for the related bank, it provides a route for an issuing vehicle that isn’t consolidated onto the bank’s balance sheet and, therefore, does not count towards the US$20bn cap.

“However, not every investor has the capability to do this. We are seeing some more sophisticated investors ‘market’ this ability as a way of differentiating themselves. Ultimately, banks are more likely to bid deals out to investors who can actually provide a service,” he notes.

Relative value

The CRT market has previously witnessed periods when new investors enter, attracted by the relative value on offer, which then exit when other opportunities arise. “We have seen cycles in which pricing tightens before, but eventually supply and demand dynamics balance out. This time around, however, I expect more of the new investors to stay,” the source observes.

The source suggests that one reason is because there is more visibility in terms of the supply side, compared to before, which is – in turn – due to there being more regulatory visibility. Another reason is that funds aren’t in the business of changing their strategy every year.

“The new entrants will have spent a lot of time and resources raising dedicated capital and explaining their CRT strategy. Consequently, they are likely to have a more consistent approach to the market today,” the source indicates.

Meanwhile, given the heightened interest in CRT from funded protection sellers, some new originators currently appear to be dedicating fewer resources to unfunded issuance. However, this may also be a function of the need to further develop and demonstrate the value of the unfunded side of the market more generally, since the number of (re)insurance players with CRT expertise remains limited.

According to Mehdi Benleulmi, head of credit – Europe at RenaissanceRe: “As a (re)insurance company, we view CRT as a partnership with our banking clients. We seek to renew our trades with the same counterparties – which makes a difference in terms of pricing, as we can approach it on a through-the-cycle basis, rather than at a given point in time. As experts in bringing efficient capital to our clients, we’re here to stay, which minimises long-term balance sheet management risk for our counterparties.”

Benleulmi, for one, hasn’t noticed any changes in the level of transparency and disclosures provided by banks in connection with CRT transactions. He suggests that while it is arguably currently a bank-oriented market, this environment could always change.

“Will the new counterparties still be there for issuers when the market turns? We expect that banks will continue to execute bilateral trades alongside widely syndicated deals. Banks utilise CRT as a tool to manage their balance sheets and therefore need to ensure that they can continue to do so in various market environments,” Benleulmi concludes.

Corinne Smith

SCI’s SRT Journal is sponsored by Arch MI and Mayer Brown. All five essays can be downloaded, for free, here.

|

US future

The European SRT market has taken years to reach its current robust state and the US market is similarly expected to take time to fully develop. In the meantime, Seer Capital Management anticipates that many of the new investors exploring the US market will become frustrated and return to their previous focus areas.

Key factors that will contribute to the growth of the US market in size and diversity in the near to medium term, according to Seer, include:

- Clarification of the regulatory environment

- Establishment of consensus around the optimal structure; likely SPVs that can be used for all types of assets and syndicated to a variety of investors

- Large banks that have completed initial deals referencing on-the-run assets, such as IG corporate loans, looking to other areas of their balance sheet to optimise capital allocation

- Smaller banks devoting the time and marshalling the resources needed to complete a first-time transaction.

“As more and more banks join the market, reg cap will become a standard tool which investors/equity analysts expect US banks to employ, as they do in Europe,” the firm concludes. |

back to top

News Analysis

Alternative assets

SCI In Conversation Podcast: Jeffrey Stevenson, VSS Capital

We discuss the hottest topics in securitisation today...

In this episode of the SCI In Conversation podcast, SCI US editor Simon Boughey speaks to Jeffrey Stevenson, managing partner of VSS Capital, about the continued growth of private lending. Stevenson discusses how the private lending market has evolved over the past decade, the role that remains for traditional lenders, where he has seen value over the past year, and more.

Stevenson outlines the development of structured capital – a combination of debt and equity – within private credit strategies, and how it offers companies an alternative to buyout funds. He also discusses the flexibility afforded to fund managers compared with traditional lenders; the attraction to healthcare, education and tech-enabled business services; and the industries that VSS has moved away from over recent decades.

This episode can be accessed here, as well as wherever you usually get your podcasts, including Apple Podcasts and Spotify (just search for 'SCI In Conversation').

News Analysis

Asset-Backed Finance

NAV in focus

Growing market 'key' to fund finance toolkit

Net asset value (NAV) lending volumes are poised to more than double over the next few years. Indeed, panellists at Invisso’s recent ABS East conference forecast that the market could grow from nearly US$150bn in 2024 to an estimated US$500bn by the end of the decade.

NAV loans are becoming an increasingly relevant tool within the broader US$1.2trn fund finance (FF) market – a sector that overall could surpass US$2.5trn by 2030, according to a recent Ares Management white paper.

Emerging in the 1980s, FF has become a critical source of liquidity for asset managers and investment funds. Historically dominated by capital call facilities – also known as subscription lines, which currently account for US$850bn of the market – FF is now seeing rising activity in NAV loans, followed by GP solutions, hybrid facilities and collateralised fund obligations (CFOs).

“The fund finance market is where direct lending was in 2010, starting to experience exponential growth. We believe this US$1.2trn market is poised to more than double in the next few years,” says Michael Arougheti, ceo of Ares Management.

In 2024, NAV loans are growing hand in hand with private markets, becoming the ‘hot’ segment in the FF space. Growth is being driven by narrowing spreads and an improved understanding of FF dynamics, transforming NAV loans from a niche, highly bespoke financing tool to a mainstream component of fund portfolios.

Ben Love, partner at Churchill Asset Management, emphasises this rapid adoption, marked by NAV loans “becoming cheaper, more well understood and regular parts of the fund finance world.”

In practical terms, NAV loans address a critical challenge for closed funds nearing the end of their investment period. By offering a means to optimise leverage without the need to raise new equity or liquidate assets, NAV loans allow funds to deploy additional capital into portfolio companies, fund acquisitions and support M&A without incurring additional equity dilution.

“Fund managers can use NAV lines not just because they can’t exit an asset, but to maintain an optimal level of leverage, even in a strong market where assets are easily sold,” says Ani Ravi, US capital markets and finance partner at Dechert.

“As it becomes more of an accepted form of financing, I think NAV lending becomes another liquidity option in the manager's toolkit. Obviously, with interest rates coming down, we're expecting a growth in the use of NAV by secondaries in particular,” adds John Sciales, vp at Evercore.

NAV loan portfolios are also increasingly appearing within the SRT market, as Macfarlanes partner Richard Fletcher notes: “The growth of NAV financing in the SRT market seems here to stay, especially as spread compression prompts managers to use leverage more strategically to meet return targets.”

Despite growing acceptance of NAV loans, they remain far from standardised. Unlike capital call loans, NAV loans vary significantly in terms of security, leverage ratios and lender preferences. Their ongoing evolution reflects the market’s adaptation to meet the unique needs of different fund types and financing structures.

“We’re really seeing NAV structures evolve in real time. Unlike capital call loans, there’s no single ‘typical’ NAV loan yet,” says Ravi, noting how lenders and borrowers are exploring different structures tailored to specific strategies and fund types.

This maturation comes with a call for increased transparency. LPs are increasingly pushing for clearer disclosures around leverage strategies, as well as consent from Limited Partner Advisory Committees (LPACs) when NAV loans involve subordinating LPs or restructuring cashflows.

The Institutional Limited Partners Association (ILPA) is one of several bodies demanding the need for such transparency, as NAV lending becomes a prominent FF segment.

NAV loans, often structured conservatively, still carry certain risks, including cross-default clauses that can trigger a loan default if any one portfolio company defaults. Yet, this can also incentivise lenders and sponsors to protect value, but it requires careful coordination.

Despite the optimism around NAV lending, a slowing economy could potentially hinder funds’ appetite for these products.

According to S&P Global Ratings, private credit funds overall are likely to face rising defaults in their asset portfolios in 2024, and this pressure could present new challenges for newer funds, with elevated leverage and tight liquidity.

Devi Aurora, md, financial institutions and alternative funds at S&P Global Ratings, suggests that if traditional exit paths like IPOs or acquisitions reopen, demand for NAV loans might cool slightly: “If the ultimate exit path opens up, you might see other options adjusting down slightly.”

However, Dechert’s global finance attorney Jonathan Gaynor argues that NAV loans are essential even in favourable markets, acting as a bridge to IPOs and other exits. “Even if exits are easy, there’s still a strong use case for NAV, providing strategic flexibility to achieve ideal exits,” he notes.

Looking ahead, with US elections and possible interest rate cuts around the corner, the outlook for NAV carries both challenges and opportunities. Ravi outlines two possible paths: “In a challenging macro environment, we might see spreads on NAV loans increase, pushing for loans closer to underlying assets. In better conditions, we’ll likely see more NAV loans, as lenders are comfortable with the relatively loose protections typical of NAV loans.”

Regardless of market fluctuations, NAV lending is scaling rapidly, solidifying its position as a key pillar of the FF market.

Marta Canini

SRT Market Update

Capital Relief Trades

More, more, more

SRT market update

The race to getting transactions wrapped up before thanksgiving is heating up, as sights are already set on seeing growth all-around next year in the European and the North American markets.

While things remain clear as mud in the US as practitioners weight up the implications of a Trump-led government in the CRT space, all systems are a go at two of the nation’s largest banking firms – Bank of America and Wells Fargo - pushing to market two deals before the end of 2024.

A source close to the Bank of America trade confirmed the spreading rumours of the deal being tied to a US$1bn portfolio of corporate loans. And while they confirmed the deal would prove to be “nothing exciting or new” from the bank in terms of its structure, as per the developments seen in the US market this year - the pricing is expected to be tight.

As for the long anticipated trade from Wells Fargo, the same market source understands that despite some quiet in the public domain, it is indeed still on the cards for Q4 (SCI 23 August). The trade is understood to reference sub-lines credit facilities.

Further details have also emerged on Banco Sabadell’s latest SRT. The deal, which references project finance and large corporate loans out of the bank’s Miami branch, is expected to price next month. The Spanish issuer is looking to place, out of the portfolio’s total volume (reportedly USD$1.3bn) the first loss (0-9%) tranche equivalent to USD$120-150m among institutional investors.

Sources close to the transaction have mentioned a “structurally almost identical deal to the previous one issued this year, however the available data makes it harder to underwrite.”

With the big banks making it a busy November for the SRT-universe on both sides of the pond, it appears smaller, regional banks could be readied to keep momentum going in Q1 as they wait their turn in line. According to one European investor, this could indicate an improved flow of deals just after the off next year and break up the lull in big bank activity in Q1.

Practitioners across Europe are also already gearing for sustained market growth next year too, as the investor expects growth to be across the board: “we’re going to see more issuers, more asset classes, and more jurisdictions in the market.”

However, from Europe’s largest SRT issuers, things are reportedly not likely to change anytime soon. According to another expert in the field, the emphasis for Europe’s biggest SRT-participating banks next year is continued growth and expansion. Thus, from the likes of Santander, BNP Paribas and Barclays, the same familiar structural packages are likely to be on offer to clients once again next year – with their ambitions instead to scale them up further, and get even more done in 2025.

Claudia Lewis

News

ABS

Pre-judgment day ABS rush in Europe

October sees strong European and UK ABS issuance ahead of US presidential election

October ended with a surge in European and UK ABS and MBS issuance, with €3.5bn placed from seven deals in the final week of the month. This included €2bn of publicly marketed deals, bringing the total level of issuance for the month to €12bn.

JPMorgan strategists note: "October’s primary activity underscores the strong demand for securitised products across Europe this year, especially as we close in on year-end forecasts. However, the anticipation surrounding next week’s US presidential election has driven many issuers to finalise deals early, minimising exposure to potential market volatility."

With no new deals in the pipeline, activity is expected to pause before resuming in November, a month that has historically averaged around €6bn in issuance, reaching €9.3bn in 2019. The year-to-date issuance of €87.7bn supports JPMorgan's forecast of €95bn for 2024, split as €53bn for the Eurozone and €41bn for the UK.

JPMorgan highlights debut issuances as a key trend, with four of October's deals being inaugural offerings, including Hampshire Trust Bank's UK BTL RMBS (Winchester 1) and Arval Service Lease’s first UK Auto ABS.

Enpal’s Golden Ray solar ABS was notable for being Europe's first public solar ABS. JPMorgan says the deal breaks “new ground in the European market, meeting a long-awaited demand for green, asset-backed securities.”

The UK BTL sector saw a record 17 publicly marketed deals, with JPMorgan noting: “While there is a marginal difference in credit enhancements for these two types, market reception has not shown a pronounced pricing bias.” Issuances were backed by seasoned collateral, averaging 24 months, with a trend towards mixed collateral pools of BTL and owner-occupied loans.

High primary supply softened secondary market valuations, with spread widening across senior tranches. JPMorgan notes: “Higher-quality, senior tranches continue to underperform compared to wider spread, non-senior risk, indicating a cautious approach from investors amid current supply and geopolitical uncertainties.”

Despite this, JPMorgan remains optimistic, forecasting strong year-end results for the European ABS market.

Selvaggia Cataldi

News

ABS

M&G unveils €200m ABS fund

Firm launches vehicle aimed at unlocking daily liquidity in high-grade securitised assets

M&G’s structured credit team has launched the M&G Investment Grade ABS Fund, a new daily liquidity fund with an initial €200m investment from pension schemes and family offices. The fund seeks to capture value in the global securitisation market, focusing on high-quality, investment-grade assets backed by residential mortgages, consumer, corporate, and automotive loans.

The fund’s strategy aligns with M&G’s existing £3.5bn investment-grade ABS portfolio, following a long-term, value-driven approach while applying ESG criteria as an Article 8 fund under the EU’s SFDR. As the European ABS market continues to expand, now estimated at €550bn, with €71.5bn in issuance in H1 2024, the timing for the fund launch is strategic, tapping into increased issuer diversity and improved asset quality.

Matthew Wardle, head of investment grade structured credit at M&G, highlights ABS’s defensive potential: “The investment case for the asset class is compelling for its exposure to granular and defensive underlying assets, low correlation with other asset classes and attractive value compared to corporate and government bonds.” He adds: “ABS performance has remained robust during recent years against a backdrop of higher interest rates, increased inflation and cost pressures.”

The fund’s daily liquidity aims to attract both institutional and wholesale investors who may be cautious about ABS’s complexity but are drawn to its “high credit resiliency and attractive value,” says Neal Brooks, M&G’s global head of product and distribution.

M&G’s fund is set to offer a diversified portfolio from day one, ready to navigate what is expected to be a high-volume period for investment-grade ABS issuance.

Selvaggia Cataldi

News

Structured Finance

Election special

As America goes to the polls and the world watches, US editor Simon Boughey - with the help of Matt Bisanz, a partner at Mayer Brown in DC specializing in bank regulation and a few others - considers what the securitization industry might expect from a Harris administration and from a Trump administration.

B3E

Harris wins.

If the Democrats win the White House again, things will probably go on much as they have been for the past several months. The B3E will get re-proposed at some date in the relatively near future and broadly along the lines Michael Barr, vice-chair of supervision, indicated in his speech in September in which capital requirements for top tier banks are likely to increase by about 9% rather than about 20% as in the original proposal. This is despite the opposition to Barr’s sentiments raised by three boards members of the FDIC at the end of September.

How quickly this will happen is of course not clear at all. As Bisanz says, the timing will depend on how quickly Martin Gruenberg, chair of the FDIC, is replaced and then how quickly his successor can get up to speed. Gruenberg is a Biden appointee and was sworn in on January 5 2023. Previously he served as senior counsel to Democratic senator Paul Sarbanes.

Under a Harris administration, Gruenberg is likely to be replaced by someone of similar sentiments and leanings so there shouldn’t be a significant change in overall policy trajectory.

Trump wins

If the Republicans win, then we can expect B3E to drop right off the regulatory agenda. “It goes straight onto the backburner, and we don’t hear about it for four years,” says Bisanz.

Agency appointments

Harris wins

In this scenario, then once again not much change is expected. The heads of the three major agencies will be replaced in time, but there is no urgency to replace any of them in the near future. So Jerome Powell will remain at the Federal Reserve, Gary Gensler at the SEC and Michael Hsu will remain acting head of the OCC, although there may be pressure from some corners of the Democratic party to change out Gensler.

A Harris administration is likely to have other priorities on where it would like Congress to spend its time rather than approving appointments to financial agencies. These might include, for example, confirming the members of her cabinet, confirming federal judges in new positions and some military promotions.

As Michael Hsu is only an interim Comptroller, then he might be replaced or confirmed at some stage, but other concerns will be more pressing for at least the next six months.

Trump wins

“If Trump wins, Chopra and Hsu go on day one,” says Bisanz. Both can be replaced at the will of the president, and though permanent replacements have to be confirmed by Senate new interim appointees can be there for any length of time. Hsu, for example, was made acting Comptroller of the Currency in May 2021 and has never been confirmed.

Bisanz also thinks that Michelle Bowman, who has been on the board of the Federal Reserve since 2018 filling the newly created community banking seat could be considered as a replacement for Powell or Barr but that this will not happen immediately or even quickly as changes to senior positions in the Federal Reserve are more controversial.

Banking regulation

Harris wins

If the Democrats retain the White House, then the ambitious regulatory schedule planned by the SEC is likely to go ahead.

Some have suggested that regional banks will be at the forefront of a new regulatory framework given the collapse of SVB and Signature last year.

“I think there is going to be pressure applied on the smaller guys. There's US$3trn of commercial real estate loans on bank balance sheets right now and US$1.9trn of that is in banks with, less than US$100bn. You can't just have these banks taken over, liquidate their portfolios out there in the market because that's going to create a downdraft on everyone else,” says a regional bank adviser.

However Bisanz thinks that this will not be a priority for a Harris administration. Gary Gensler has indicated in the past few years that his priorities include areas like regulation of private funds, crypto currencies and enforcement of climate change disclosure. This is likely to remain the case.

Trump wins

If Trump is in the White House again, not only is there likely to be no new regulations but there will be a rollback of regulations emanating from the last four years. Bisanz indicates that SAB 121, the Gensler initiative dealing with accounting for crypto currencies, will be right in the cross hairs of a new Republican administration. In May of this year, the Senate voted to kill off SAB 121 by a hefty majority including 12 Democratic votes

Climate change regulation will also disappear as if they were never there, and several of Gensler’s initiatives on private fund regulation will be on the chopping block, he expects.

What should the securitization industry fear most?

Harris wins

If Harris wins, then there is a lot to fear, no question about it. Rohit Chopra has shown his keenness to intercede in issues highly germane to the business in his litigation against student loan trusts. Elizabeth Warren, the Massachusetts senator viewed as a leading progressive, has expressed views about the desirability of interest rate regulation. Warren is a vocal advocate of consumer rights and, for example, proposed and established the Consumer Financial Protection Bureau (CFPB) currently headed by Chopra and a bete noire to the right. Meanwhile, there have been other voices expressing concern about synthetic securitization. Who knows where any of this may lead over a four year period, but it wouldn’t be anywhere good for the US structured finance market.

Trump wins

However, the industry shouldn’t get carried away with the idea of significant relief coming its way if Trump wins. It’s doubtless distressing for the industry to hear, but it’s simply not a high priority for Republicans. “It won’t be as interesting to the administration as other topics Trump has brought up. At best there will be no more scrutiny, but things won’t get significantly better,” says Bisanz.

It’s also worth noting that a clean sweep of House, Senate and presidency by either party will accentuate the effects of either. “I think a sweep on either side creates much more instability,” says the regional bank adviser.

Simon Boughey

News

Asset-Backed Finance

Monroe closes maiden CFO

Firm closes new vehicle in strategic private credit push

Monroe Capital has closed its inaugural collateralised fund obligation (CFO) – Monroe Capital CFO I – a US$315m vehicle designed to provide investors with diversified exposure across Monroe’s private credit platforms. The newly launched CFO marks a landmark step in Monroe’s private credit expansion, integrating its senior secured direct lending and alternative credit solutions into a single offering that includes both rated and non-rated securities.

Historically active in both CLO and ABS markets, Monroe’s latest CFO structure offers additional flexibility to investors. Monroe President Zia Uddin further explains: "The capital efficient structure of this CFO allows investors, such as insurance companies and other rating focused investors, a bespoke solution to our entire investment platform tailored to their unique investment needs.”

The structured credit market, valued at approximately US$12tn, has been a key growth area for Monroe. With US$19.4bn in AUM as of October 1, 2024, Monroe’s latest CFO not only expands its product offerings but also solidifies its position within private credit markets.

“We are thrilled to close our first CFO which provides investors exposure to Monroe’s lending platform through a single offering,” says Seth Friedman, head of structured solutions at Monroe. “We appreciate the support and confidence shown to us by our investors.”

The transaction was structured with Jefferies serving as the lead structuring agent and sole placement agent, Carlyle acting as the structuring advisor and Dechert providing legal counsel to Monroe.

Marta Canini

News

Capital Relief Trades

Pillar 3 league tables

Barclays and Santander lead SRT issuance

In a brief published this morning, rating agency S&P highlights the well-known view that Barclays and Santander dominate European SRT issuance volumes.

Through examining second-quarter pillar 3 disclosures on retained SRT tranches, S&P categorises European banks and their non-trading book exposures to originated SRTs.

In terms of methodology, S&P notes that SRT transaction structures tend to be similar, albeit not identical, across European originators. European banks' SRTs are mostly bilateral, synthetic deals in which they typically retain the senior tranche representing about 80%-95% of the reference portfolio and sometimes a small first loss tranche covering the expected losses on the reference loans.

Barclays’ (who tops the table) June Pillar 3 report reveals a total volume of £96.41bn (£49.756bn of which reference corporate loans synthetic securitisations) with retained SRT tranches. Similarly, Santander reports a total volume of €56.575bn (€35.960bn of which reference corporate loans) of synthetic securitisation exposures in its June Pillar 3 non-trading book. At the lower end of the table, Rabobank reports €521m of synthetic securitisation exposures (all of which referencing loans to corporates).

Furthermore, S&P highlights the asset class’ track record of loss absorption. For instance, Barclays disclosed in its second-quarter 2024 results that it had claimed about £250m of credit losses since 2016 through its SRTs. Similarly, Deutsche Bank reported credit loss provisions on two particular corporate exposures in its third-quarter 2024 earnings, and said that about 70% of this sum was mitigated by credit concentration hedges.

Vincent Nadeau

Talking Point

CLOs

Democratising investment

Christian Parker, structured credit partner at Paul Hastings, argues that ELTIF 2.0 could represent a breakthrough for retail access to credit

It’s a well-established truth that European retail investors have no access to credit investments in the form of loans. However, this isn’t quite right and overlooks the role of investment trusts, which have for many years offered retail investors exposure to credit markets. Funds managed or associated with Fair Oaks, CVC Credit Partners, AXA Investment Managers and others all offer closed-end funds listed on stock exchanges, where retail investors can buy access to institutional loan investments in small denomination format, either directly or via CLOs and similar intermediary securitisation vehicles.

However, for various reasons, the investment trust market has long been shrinking. Major players like Neuberger Berman and Blackstone have closed or are closing down loan and CLO equity vehicles, respectively, and investment trusts have never achieved any real traction in the EU, even when shares are denominated in euros.

The gold standard for retail EU investors has always been the open-ended UCITS market. The long-established UCITS criteria has supported investment in securitisations for many years and may be on the brink of a welcome breakthrough with the recent launch of a CLO ETF by Fair Oaks.

The UCITS regulatory focus on liquidity and open-ended offerings has never been amenable to relatively illiquid loans and other non-securitised investments. Therefore, while it is accurate to say that European loan investments remain substantially confined to the institutional alternative investment fund (AIF) market, the existence of vehicles like investment trusts mean there are some exceptions to the rule.

A time for change: the impact of ELTIF 2.0

That may be about to change as credit managers focus more closely on the European Long Term Investment Fund Regulation and recent reforms made earlier this year (known as ‘ELTIF 2.0’). This regulation was originally brought into being in 2015 to facilitate investment in long-term investments, such as real estate and loans, primarily for institutional and high-net-worth European investors. However, ELTIFs got off to a slow start, principally because their prescribed investment criteria were dogmatically ESG-focused and hence too prescriptive to be attractive to the loan market.

However, ELTIF 2.0 reforms, effective in 2024, have dispensed with much of the dogma and offer more flexibility. For instance, the minimum holding of long-term assets has been reduced to 55% (from 70%), and the ability to offer open-ended liquidity has been much enhanced. This is a notable improvement to ELTIF 1.0, where redemptions were much more difficult.

Additionally, the reforms support retail investor participation through restrictions on retail offerings being removed and a UCITS-like ‘marketing passport’, allowing ELTIFs to be offered to all retail investors across the EEA.

This opens the door for credit managers to create open-ended funds that invest in loans and deliver consistent and recurring income associated with that asset class. It comes at an opportune time for European demographics.

That said, there are many obstacles to overcome. Retail distribution, for instance, has traditionally been more expensive compared to institutional distribution. Additionally, the administrative bureaucracy and costs associated with regulated funds pose further challenges.

There are also restrictions on certain activities that are not dissimilar to those imposed on UCITS funds. This includes limitations such as short selling, leverage levels and the use of derivatives – all of which will need to be adhered to. That said, managers have invested the time to navigate the UCITS market, recognising that there are additional costs associated with dealing with the retail market; we expect a similar investment in ELTIFs.

What does the future hold?

Despite these obstacles, the attention to detail brought to bear by the European Commission in ‘democratising’ the asset class selection and rationalising the liquidity rules for funds of this nature (e.g. redemption periods and redemption levels) gives real hope that this could be a major breakthrough for credit managers.

Paul Hastings recently carried out in-house research that suggests that a substantial majority of loans that make up the CLO market will qualify as eligible assets for ELTIFs, as will high yield bonds that already qualify under their UCITS eligibility. This means that a truly retail open-ended fund, delivering broadly syndicated loan returns, is very much within reach.

While factors such as Brexit currently prevent UK retail investors from directly benefitting from an ELTIF investment, because it will be deemed an unregulated collective investment scheme and so restricted in its marketing, one might reasonably expect that the FCA/UK authorities will in due course extend the passport afforded to EU UCITS funds to ELTIFs. If not, credit managers could offer UK retail access by way of the newly introduced UK platform, the Long-Term Asset Fund (LTAF), either directly or via a feeder fund.

Historically, the EU’s approach to retail investment opportunities has been cautious and protective. However, the successful implementation of UCITS sets a strong precedent for the retail investment market, and the ELTIF reforms are well on their way to following suit.

Talking Point

CLOs

EU CLO performance realigns with loan index post-volatility

CLO Research Group's Tan analyses how EU CLO managers' performance fluctuated from strong pre-pandemic gains to challenges amid recent market volatility

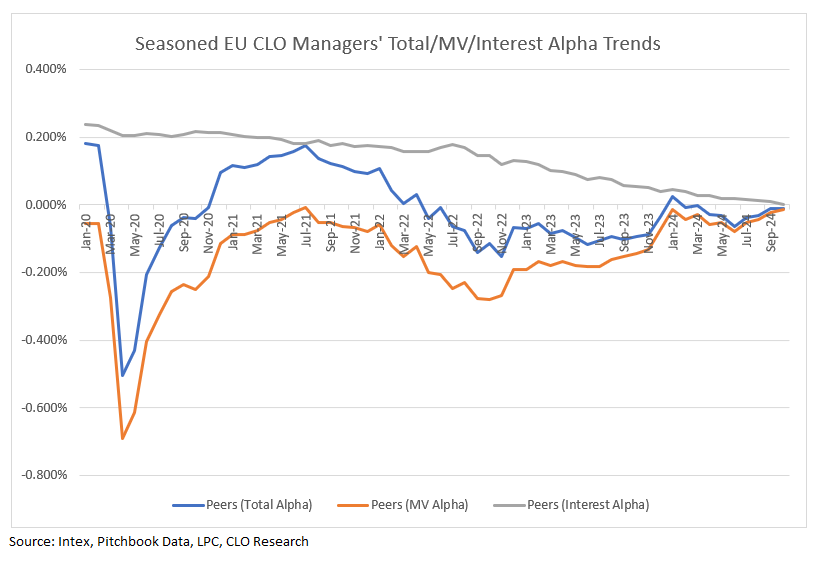

European CLO managers have returned to performing on par with the Morningstar European Euro-Denominated Loan Index on average following four challenging years, says Poh-Heng Tan, founder of CLO Research Group, in this exclusive article for SCI. Yet individual results vary widely and investors should remember that CLO managers do not eliminate investment risk.

Prior to the pandemic, managers delivered strong performance, averaging close to 20bps of alpha. However, in April 2020, the average alpha sharply declined to -50bps due to the pandemic. Despite these challenges, some managers adapted quickly, recovering faster by capitalising on market dislocations, while others lagged behind.

In 2021, as the loan market rebounded, EU CLO managers regained momentum, delivering healthy positive alpha on average. However, from mid 2022 to late 2023, market volatility driven by inflation, high interest rates, and recession fears led to underperformance. On average, managers trailed the loan index by 5bps to 15bps. Contributing factors included exposure to fixed-rate assets and a downward trend in interest alpha as rates rose.

By October 2024, EU CLO managers were performing in line with the loan index, showing zero alpha. While some managers consistently outperformed the index, the graph above highlights the challenge of delivering sustained alpha over time for the average manager. CLO managers closely tracked market value (MV) returns in strong loan markets but underperformed during weaker periods.

To calculate the total, MV, or interest return alpha, we begin by determining the respective investment return for each period, from a deal’s closing date to the most recent reporting date. This involves compounding the portfolio’s monthly (or other periodic) total, MV, or interest returns since the closing date. Next, we annualise the portfolio’s total, MV, or interest return and compare it to the annualised return of the index. The difference between these returns represents the alpha (total, MV, or interest return alpha) as depicted here.

Readers should note that this study examines a sample of 218 deals from the 2015 to 2019 vintages. For 2019 deals, their performance data are included from Aug 2021 onward.

For more details on the alpha performance of each seasoned manager, visit CLO Research Group.

Market Moves

Structured Finance

Job swaps weekly: Ogier snaps up Dublin-based partner

People moves and key promotions in securitisation

This week’s roundup of securitisation job swaps sees Ogier hiring a structured finance veteran from Matheson as partner in its Dublin office and promoting a real estate managing associate to partner in its Jersey practice. Meanwhile, Sidley has hired two long standing senior capital markets partners from Latham & Watkins, while Latham & Watkins has made a number of promotions globally, including the appointment of a real estate partner and three structured finance counsels.

Ogier has hired Matheson’s Richard Kelly as partner in its Dublin office. Kelly, who leaves his role as partner at Matheson after 15 years with the firm, advises international and domestic clients on debt capital markets transactions, with a focus on structured finance, CLO, ABS and other securitisation products. He also advises on prime brokerage services including derivatives, repos, securities lending and crypto trading, as well as regulatory issues relating to the trading of financial instruments and digital assets.

The firm has also promoted Amy Garrod to partner in its Jersey practice. Garrod focuses on real estate holding structures and borrower side finance transactions involving companies, limited partnerships and Jersey property unit trusts. She joined the firm in 2009 and is promoted from managing associate.

Elsewhere, Sidley has hired Latham & Watkins partners Scott Colwell and Patrick Kwak as London-based partners in its capital markets practice. The pair will advise clients on debt securities offerings and leveraged transactions.

Kwak leaves his role as partner at Latham & Watkins after 10 years with the firm, while Colwell was with the firm for 23 years. The departures from Latham & Watkins come three months after CLO-focused partner Alex Martin joined Milbank’s London office as a partner in its alternative investments practice (SCI 9 August).

Meanwhile, Latham & Watkins has made a series of promotions to partner and associate, including the appointment of London-based associate Calvin Ng as partner in its real estate practice and corporate department. Ng joined the firm five years ago from Linklaters and advises sponsors, investors and other financial institutions on real estate credit transactions.

The promotions – of which there are 51 globally – also include the elevation of structured finance associates Jana Zupikova, Daniel Marcus and Ed Comber to counsel. Zupikova and Marcus are based in London, while Comber is based in New York.

Rick Hanson has joined Cadwalader as a partner in its London capital markets and leveraged finance and private credit practices. He was previously a partner at Morgan Lewis, which he joined in April 2022, having worked at Orrick, Ropes & Gray and Linklaters before that. Hanson advises alternative investment funds, asset managers, insurance companies and banks on securitisation and bespoke finance solutions across a wide range of alternative and illiquid asset classes, including CRE back leverage and fund finance transactions.

Redwood Trust subsidiary CoreVest has promoted Fred Matera to ceo, reporting to Dash Robinson, Redwood’s president. Matera has served as CoreVest’s co-head for the last year and has been an integral part of Redwood’s leadership team since 2019, most recently as cio. In his new role, he will be responsible for overseeing all aspects of CoreVest’s operating strategy, including product growth and distribution.

Scotiabank has promoted Jonathan McCormick to md, structured credit origination and distribution, based in Dublin. McCormick joined the firm’s newly established structured credit business in June 2023 as a director, securitised product sales. Before that, he spent 18 years at Deutsche Bank in a number of structured finance-related roles.

And finally, MUFG has hired Fidelity International's Raphael Charon as md and head of middle market direct lending. Charon leaves his role as head of direct lending origination after two years with Fidelity. He previously spent nine and a half years at Bank of Ireland, in addition to spells at RBS and HSBC.

Kenny Wastell, Corinne Smith

structuredcreditinvestor.com

Copying prohibited without the permission of the publisher